Everyone who has read my newsletter know that I have a weak spot for Nintendo. In fact, I made a video and article (HERE) on why I think the company is undervalued over the long-term:

That analysis was about my hopes for the a future path for Nintendo. A path where they manage to pivot away from their dependency on gaming consoles to focus on merchandise and theme-parks as a new revenue stream.

However, the company is definitely not there yet. In fact, almost 95% of their revenue comes from their console and their video games sales. This is why I have decided to do an analysis on its present standing:

So, HERE WE GO!

TL;DR

Nintendo is a power-house! Almost all of us have found memories of the company either playing Zelda on Game boy under the sheets after bed-time, or watching grandma smashing a serve in Wii Sports.

Partly due to increased sales during Covid-19, Nintendo has become the 11th most valuable company in Japan. Its current main console, the Nintendo Switch, is on its way to become the most sold gaming console in history; beating PS5 & Xbox Series X by a landslide.

Today’s Nintendo is extremely reliant on sales of their gaming console. About 97% of the company’s sales consist of hardware and software sales surrounding the Nintendo Switch.

The latest earnings report indicate that Nintendo Switch sales have reached a plateau. To make matters worse, the company’s leadership does not seem have a succession plan to the Switch. Hence, in the short term Nintendo’s revenue will likely go down.

Long term, I believe that Nintendo will increase their revenue through other segments, most notably merchandise and theme parks, but the company has not shown that they can pivot yet.

Nintendo is still raking in cash and its balance sheet is incredibly strong, so there are no worries that the company won’t survive a coming recession.

For me, I would not buy the stock at its current price, but if I had it, I would definitely hold onto it!

My stock rating: Hold

What is Nintendo?

Almost everyone knows about Nintendo:

It is one of the world's leading game makers that mainly develops, manufactures, and sells game hardware and software.

The present company was registered in 1947, but it was actually founded in Kyoto in 1889. The company originally produced handmade Hanafuda playing cards. After venturing into various lines of business during the 1960s and acquiring the legal status as a public company, Nintendo distributed its first console, the Color TV-Game, in 1977.

The company was listed on the Tokyo Stock Exchange (TSE) in 1983 which has been its home ever since. So called mirror shares (shares that is directly correlated to Nintendo’s share on TSE) can be bought on the US Nasdaq and the German DAX stock market.

The Nintendo Switch is the company’s most sold home console ever even though it only came out in 2017. However, other massive hit consoles from the company include:

Game Watch

Famicom/Nintendo Entertainment System

Game Boy

Super Nintendo

Nintendo 64

Nintendo DS

Nintendo Wii

Nintendo has also developed some of the world’s most famous games in-house, such as Donkey Kong, Mario, Animal Crossing, Zelda etc.

Present Nintendo revenue streams

The total number of Switch hardware units sold, which is the company’s current main console, is about 108 million units. The company has also sold more than 600 million games for the Switch. This is thoroughly impressive as before the pandemic, by far the highest sales of a Nintendo's home video game consoles was the Nintendo Wii with a 100 million units sold.

However, the rival Sony with its PlayStation 2 is still the best-selling console of all time, with a cumulative total of more than 155 million units sold. Talking more recently, it seems that the sales volume of the PlayStation 4 will land around 110 million units, which the Switch will beat this year.

With these impressive numbers, it might be easy to think that Nintendo Switch has won this generation, but do not discount Sony! Although the latest model of PlayStation, the PlayStation 5, started selling in November two years ago, it is not possible to judge exactly how much momentum it has because it is still very difficult to obtain. However, it will probably chase after Switch sales with a tremendous momentum once available in stores.

Looking at the game industry widely, the market size of "mobile games" has grown rapidly due to the spread of smartphones, and many believe that the demand for so-called home video game consoles has reached a plateau.

The main question is how Nintendo, the king of the video game market, will survive this. So far, they have managed to stay relevant, but the Switch has been out for 5 years now and Nintendo does not seem to have an additional home console in the works…

Nintendo’s business performance

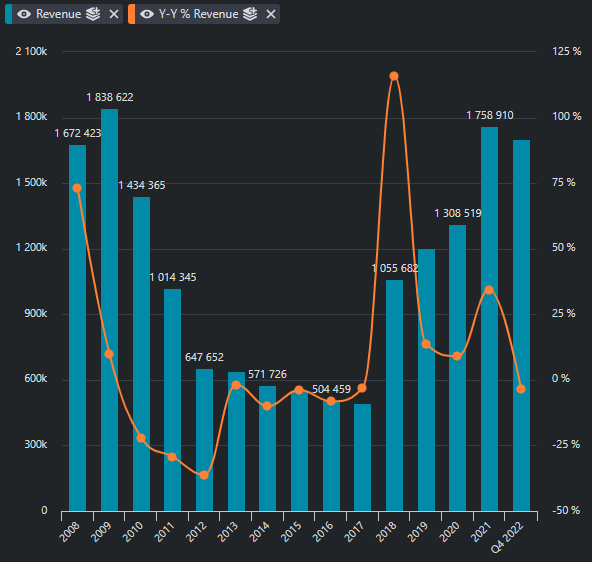

Let's take a look at the changes in business performance. Looking at the recent momentum, it looks like Nintendo has done better each year, but if we zoom out the time-horizon a bit, that is not the case:

Sales growth rate

Looking at the flow so far, overall sales doubled with the release of Nintendo Switch in the fiscal year ending March 2017 and the fiscal year ending March 2018. Since then, sales have continued with double-digit growth.

However,, the record high sales were about 1.8 trillion yen in the fiscal year of 2009. That year was the height of the Nintendo DS series for handheld game consoles. As for home video game consoles, the Nintendo Wii performed well and recorded record high sales.

After that, the number of units sold decreased, and sales gradually settled down due to the flop that was Nintendo Wii U and forced price reductions.

Sales by region and composition

Moving to the present age, looking at the sales composition ratio by region in the nine months until Q3 in the fiscal year ending March 2021

Japan: 22.4%

Americas: 41.1%

Europe: 25.6%

Others: 10.9%

The United States accounts for about 40% of sales, and Nintendo is one of the few Japanese companies that still is world leading in the software and hardware space abroad.

As for the composition of the sales: about 1,361 billion yen (about 97% of sales) consists of game-only hardware and software (almost entirely connected to the Nintendo Switch). In these sales, 55.6% of is revenue from the hardware, so about 750 billion yen. Nintendo doesn’t break out software sales, but its safe to assume that software and accessories occupy the remaining 600 billion yen.

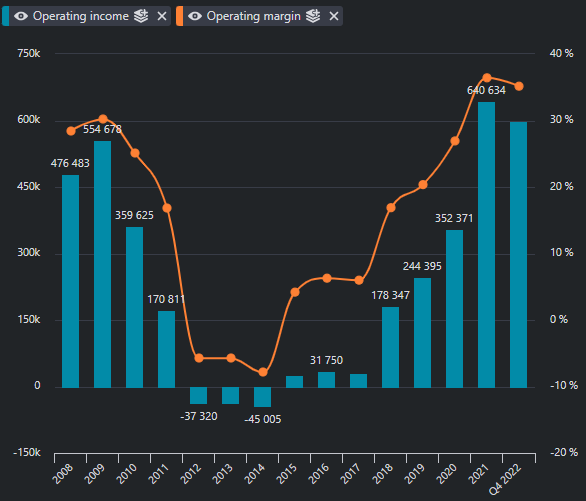

The profitability of Nintendo

Next, let’s look at profits:

The movement of the company’s profits is almost 1-to-1 with the ups and downs of console sales.

As you can see from the graph, it seems like the sales of Switch consoles might have plateaued in 2021, as a record 641 billion JPY was reached, but has now gone down to around 600 billion JPY (Nintendo’s fiscal year ends in March, so 2022 ended in March 2022).

Because Nintendo’s sales are greatly influenced by the sales of hardware , the wave of business performance is very volatile, as its stock price below shows:

The middle period of low profits, lets call it ”the sales valley” is usually where new machines are developed. There are characterized with a temporary fall into negative profits.

It is undeniable that Corona has boosted Nintendo’s business performance, so as Corona has settled a bit by the end of 2021, the momentum will likely drop during 2022.

For this year, both sales and profits will likely fall below the 2021 levels.

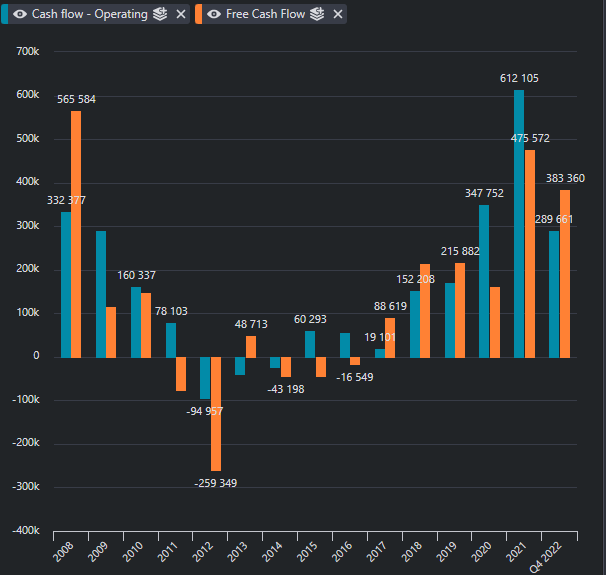

Cash flow trends

As with the recovery of business performance by the Switch, both operating Cash Flow (CF) and Free Cash Flow (FCF) are growing steadily at this point. Since there is almost no capital investment now, Nintendo does not seem to put a lot of money on R&D to develop a new console. This is a strong indication that the operating CF will be partially returned to shareholders as a dividend and share buybacks.

However, unlike US companies, Japanese companies tend to fluctuate their dividend according to business performance, so I think it is not recommended to hold the stock for the purpose of obtaining stable dividends.

Nintendo’s ratio of capital investment to cash flow is low. This is because the company is "fabless"company in terms of manufacturing. This means that it designs and sells the hardware but does not manufacture the silicon wafers, or chips, used in its products. *Nintendo is shy about this fact, but acknowledges this in their CSR-reports.

Interesting stock performance indicatior

The performance and stock prices of Nintendo’s main console manufacturers, "MegaChips" and "Hosiden", tend to move in line with Nintendo's movements.

That is to say, the performance of these business partners are often a leading indicator on Nintendo’s future hardware sales, so a slump in their stock price is a strong bet that Nintendo’s stock will tank shortly after.

Summary

Looking only at the past 10 years, the stock has performed remarkably well and is constantly rising. However, in reality, it is a company whose business performance and stock price fluctuate in correlation with the life cycle of its main gaming consoles.

This is an huge warning flag presently as Nintendo Switch sales are going down.

Nintendo’s leadership has also gone out and said that they are insecure about the follow-up to the Nintendo Switch. As gaming consoles still are their bread and butter, this is a huge warning sign for a downturn in the stock to come…

Hence, in the short term Nintendo’s revenue will likely go down.

However, it’s not all doom and gloom. Nintendo is a wonderful company that has survived many downturns before and always come out much stronger. As my previous analysis concluded, I definitely want to hold the stock for the long haul.

I do believe that Nintendo will increase their revenue through other segments, most notably merchandise and theme parks, but as their gaming consoles still drive their profits and the company has not shown that they can pivot, it is a high risk to bet on that this strategy will succeed.

This is to say, if you are risk averse, I would stay away from the Nintendo stock at the moment.

Important to note is that presently, the company is still raking in cash and its balance sheet is incredibly strong, so there are no worries that the company won’t survive a coming recession.

For me, I would not buy the stock at its current price, but if I had it, I would definitely hold onto it!

[Stock-Analysis] Nintendo: Should You Buy the Stock Today?