Last week, I wrote about three arguments for buying real estate in Japan (click HERE to view it).

I hope you haven’t bought a house in Japan yet, because this week I will go over the top three arguments against buying real estate in Japan:

Arguments Against Buying Real Estate in Japan:

1# Japanese People are Still Afraid to Invest in Real Estate

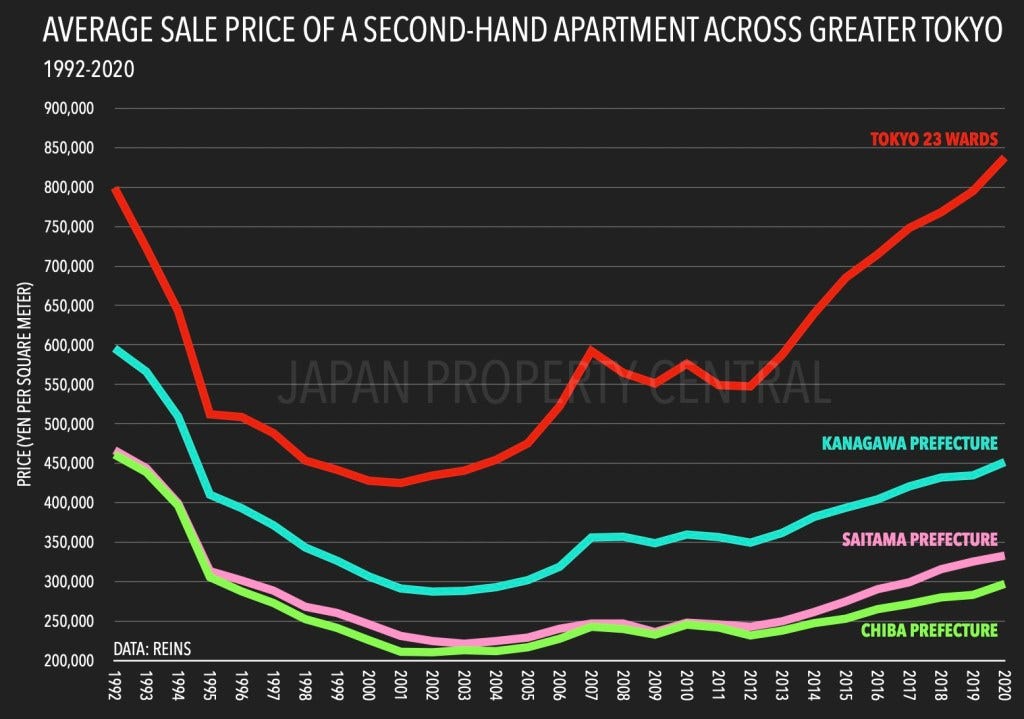

Housing prices in Tokyo have risen by approximately 5% since 1992, and in almost all other prefectures housing prices are nowhere near the pre-bubble era prices …

At the same time, from 1992 to today, the average property prices in London have increased by 593% (UK Land Registry Data) or 640% in New York City (Data from Zillow & GO Banking Rates).

Simply put, Japanese real estate prices have grown abysmally slow since 1992, especially compared to foreign peers.

If historical data is anything to go by, when you one day decide to sell your little condo in Tokyo many years from now, it might just cover the cost you purchased it for...

The major reason for this is that the trauma the bursting of the asset bubble in 1992 (biggest asset bubble in history mind you) runs so deep in Japan’s collective psyche that real estate is still seen as a risky and unattractive investment.

However, “thanks” to foreign investments, recent trends have pointed to Japanese real estate prices increasing substantially. Prices for newly built real estate, especially in the Tokyo, have risen significantly since 2013. In 2021, the amount of investment by overseas investors reached 1,330 billion JPY, an increase of 30% from the previous year. This is the first time in history the investment amount from foreigners has exceeded 1 trillion JPY.

Again, the rise in Japanese housing prices is reliant on foreign investments pouring into the Japanese real estate market, so any sentiment change on Japanese property from abroad will likely wreak havoc on its property market.

2# Earthquakes, Tsunamis, Typhoons & Volcanos

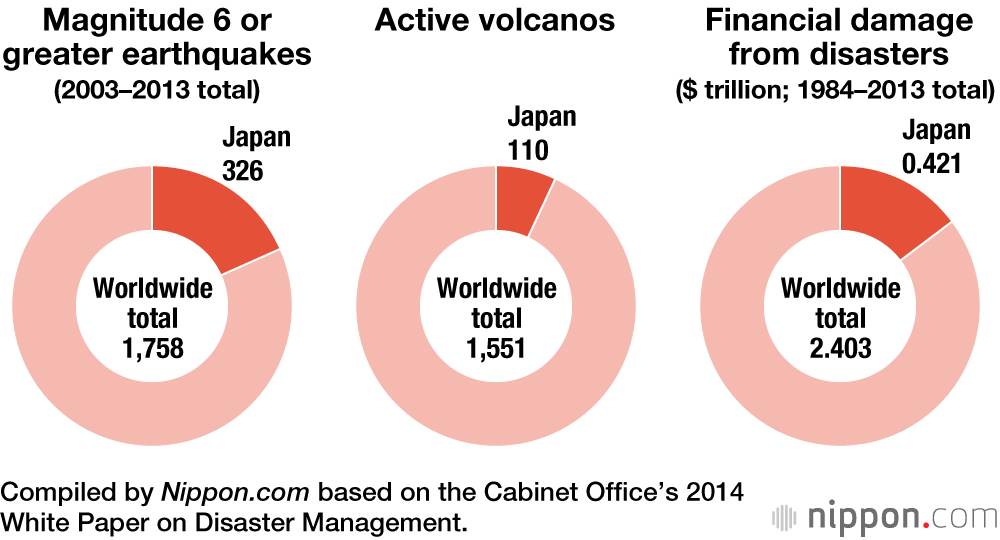

Although Japan only accounts for 0.28% of the world’s land area and just 1.9% of its population, it is the site of 18.5% of earthquakes with a magnitude of 6 or greater and 7.0% of all active volcanoes. This was the finding of a 2014 white paper on disaster management:

The harsh reality of a nation so prone to earthquakes, tsunamis and volcanoes is that its people don’t see properties as investments.

It’s beaten into the psyche of the Japanese people that properties constantly get razed and rebuilt and therefore the depreciation for buildings are bigger than most other places in the world.

Repairs can usually be made and the Japanese do enjoy some of the world’s best earthquake resistant buildings. However, repairing aged structures is costly. Even the best homes will have damage after a few 8.0 earthquakes.

With that said, land prices are seen as long term investments by Japanese people, but except for major cities, they have also depreciated over time:

3# Population Decline

If there is one thing Japan is famous for, it’s that the country’s population is declining rapidly.

Japan’s population has been declining since 2009. Back then, the population was 128.56 million and is expected to be less than 125 million by the end of 2022. The population is expected to fall below 100 million by 2058, and if the trend continues, the population will continue to decrease to just above 50 million by 2100.

I won’t go into the details on why this is happening, but the main cause is the rapidly decreasing number of births, which is currently at the lowest it has been since data started being collected in 1899. In 2021, only 811,000 babies were born in Japan – 29,500 less than the number from 2020. The fertility rate in Japan is 1.4 births per woman, far below the population replacement of 2.1.

This is bad for real estate pricing, especially considering that at average, a 1% decrease in population has a 5% decrease in property prices (Hashimoto et al., 2020).

However, major cities and popular tourist destinations in Japan are experiencing rapid population growth as people from rural areas are migrating for better opportunities.

The figure below (figure 7) shows the growth rate of house prices by prefecture using different time periods. The map on the left shows cumulative price changes between 2002 and 2018. It shows that compared to the level of house prices in 2002, all prefectures, except for Tokyo, experienced a decline in house prices (from -5 to -15%).

By contrast, the map on the right shows cumulative house price changes since 2014 by prefecture. Compared to the map on the left, numerous prefectures experienced house price appreciations in recent years, an average 1.9 % nationwide since 2013. The magnitude of price change, however, varies greatly across prefectures: greatest gains seen in Miyagi, Fukushima by 18 % (due to the low base effects related to the earthquake), Tokyo (16 %) while losses have been recorded in Akita (-6.5 %), Shimane (-5.5 %) and Yamanashi (-4.8 %).

In general, house prices in large cities and tourist destinations exhibited major price appreciations, especially led by constructions of condominiums.

In fact, despite the declining population since 2009, the total number of households in Japan continues to increase.

This is due to the share of “three generation” type families declining dramatically as younger people move into major cities, whereas the sum of one-person and couple-only increased to exceed 50%. Less people living together = more demand for property!

However, if the population continues to decline at its current rate, the influx of people to bigger cities will subside over time, and then the real estate prices will likely decline. In fact, the demand for one-person and couple-only houses is projected to subside as early as 2030 (Hashimoto et al., 2020).

So in the short- to medium term (10 to 20 years), property prices in major cities will likely go up with the population influx, but eventually, if the population decreases at the same rate, the influx will stop and they will also fall…

In Summary

Japan’s real estate market is gloomy to say the least:

The Japanese population still do not see real estate as the same low risk, high reward asset as the rest of the world does, and who can blame them.

Traumatized by the bust of the world’s biggest asset bubble in 1992 and a constant barrage of tsunamis, earthquakes and volcanos, they have every reason to doubt the appreciation of the Japanese housing market.

And if that wasn’t enough, the Japanese population is shrinking rapidly and by the end of this century, it will likely go down from today’s 125 million to just above 50 million by 2100.

However, there are glimmers of hope even on the negative side. The population decline has increased the influx on people to major cities which are fueling their property prices. Also, many foreigners are pouring in money in the Japanese real estate market, especially major cities and hot tourist spots.

At the end of the day, if the negative sentiment among Japanese people continues, while its population slowly declines, Japan’s real estate prices will likely decline with them…

NOTE

Before , you should definitely check out my article on why investing in real estate in Japan might actually be a great idea, HERE.

Also, If you are interested in the evolution of real estate prices in Japan, I highly encourage you to read the International Monetary Fund (IMF) working paper “Demographics and the Housing Market - Japan's Disappearing Cities” from 2020 uploaded here:

The paper dives deeply into the issues and possibilities of the Japanese housing market.

Should I Invest in Real Estate in Japan? Three Arguments Against